Selling Property Subject To Mortgage

Today I just wanted to put some information together about selling your house subject to an existing mortgage. While the process is simple, it’s not commonly seen. Since most home owners aren’t aware of this method to buy and sell real estate, here’s a quick rundown of what it looks like.

So what exactly does it mean to buy or sell subject to an existing mortgage?

Typically the purchase agreement is just like a traditional sale, with one small change. There will be an addendum (additional agreement) stating that the purchase is subject to the underlying mortgage, meaning the buyer will be making the existing mortgage payments, rather than providing the funds for the seller to pay the balance off in full.

What about the “due on sale” clause?

The due on sale clause is something that exists on just about every mortgage these days. The due on sale clause basically states that if the property attached to the mortgage is sold, they can accelerate the payments and even call the balance due in full. I see it as a bit of a boogeyman – something that people are often scared of, but in a sense is’t real. Don’t get me wrong, the due on sale clause exists; It just rarely gets enforced and when it does, I’m sure it’s for good reason. In general, so long as the bank is receiving the payments and their asset is properly insured (this is very important), they’re probably not going to care that it sold. They simply want their monthly payment without any headaches. The track record of buying properties subject to an existing mortgages speaks for itself. I personally have not had one called due and I have never spoken directly to an individual that has. I have only heard of people that it has happened to. Chances are that in most of the cases when this happens, it was probably because something wasn’t done properly, such as not having appropriate insurance in place with the correct mortgagee listed.

It’s important to note that while the due on sale clause exists, it’s simply a right the mortgage company has. The buyer and seller have no ethical or legal obligation to notify the bank that the house sold. The bank will see it transfer and will more than likely check things like proper insurance. I think it’s important to be aware of the risk associated with the due on sale clause, but as a professional that buys houses using this method, I’m not concerned with it, so as a seller you probably shouldn’t be either.

Will I be able to get another mortgage?

A common concern with selling subject to is the ability to get a mortgage on another house. If you otherwise qualify for a mortgage on a new property, but you still have the mortgage from your old house you sold subject to, we certainly can NOT guarantee that won’t prevent you from getting the new mortgage. What I can say though is that there are a lot of lenders out there. Some are very stringent and others give more consideration. There are also specific mortgage guidelines that cover this (see here and here). Some lenders may simply require a copy of the purchase agreement and proof of payments so the income (payments) you receive from your old mortgage, offsets the debt.

Is it legal to buy/sell subject to the mortgage?

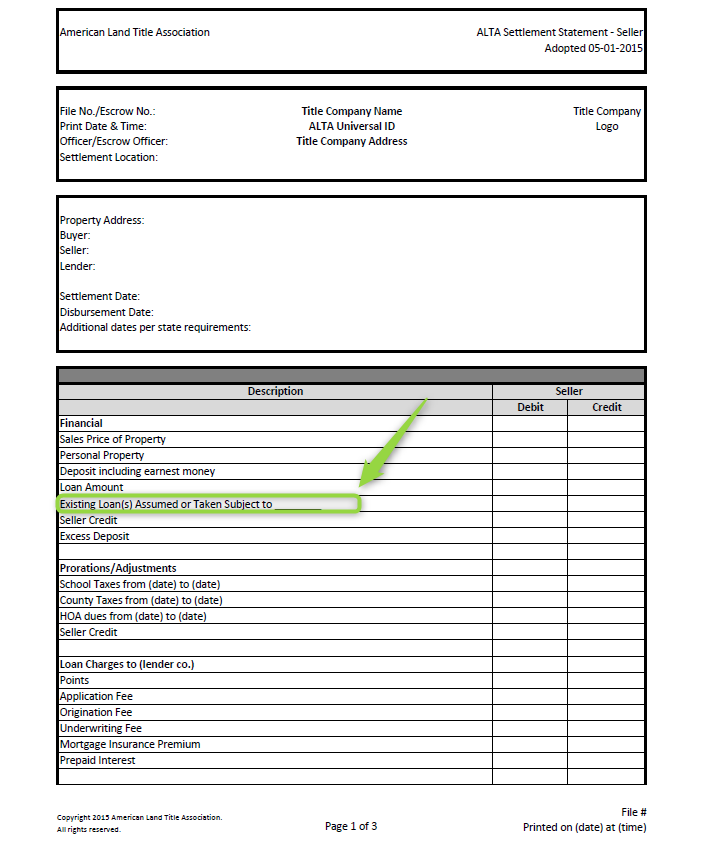

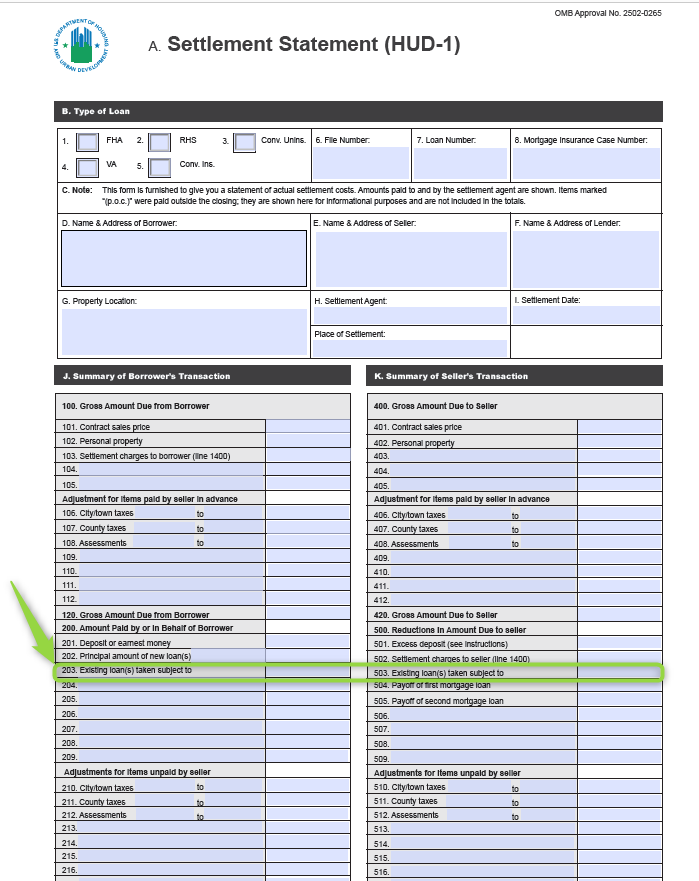

In short…yes. It is absolutely, 100%, without a doubt, completely legal. In fact, there are even line items on the HUD (a federal document) and ALTA settlement statements. If it were illegal, or even frowned upon, I’m pretty sure the federal government and title companies would leave it off the statements. You can see the line items in the below images:

What are some situations where selling subject to often makes sense?

Like any sale type, traditional included, selling subject to is not always going to be the best option and does not fit all situations. Where it tends to be very beneficial is in situations requiring a very fast sale or low equity. The most common situations we see this method of selling include:

- The owner may still live in the house, but simply can’t keep up with the expenses. This is often due to an unforeseen job loss, medical bills, and sometimes even a death. Sometimes these situations lead to foreclosure, in which case a subject-to mortgage may be the only realistic option to keep the bank from taking it.

- A house that has little to no equity, also known as being “upside down” or “under water”. In these situations you may have to pay money out of pocket if you sell traditionally, using an agent and the MLS, and if you sell for cash in these situations you’re probably going to come out of pocket even more. With subject-to you may be able to get money in your pocket from the purchase!

- Often times, people are transferred for a job, but are not successful selling their house traditionally, so they’re left making two mortgage payments. This even happens in “seller markets” with very nice properties. How long could you make two mortgage payments? Many times all it takes is one contract falling through (which is very common) for that house to become a burden difficult to carry.

If you’re serious about selling on owner finance then I cannot stress enough the need to sell under one of the below scenarios:

- Sell to professional investors, like People First Real Estate Advisors

- Use a competent attorney that has experience with not only real estate transactions, but closing subject-to in your state!